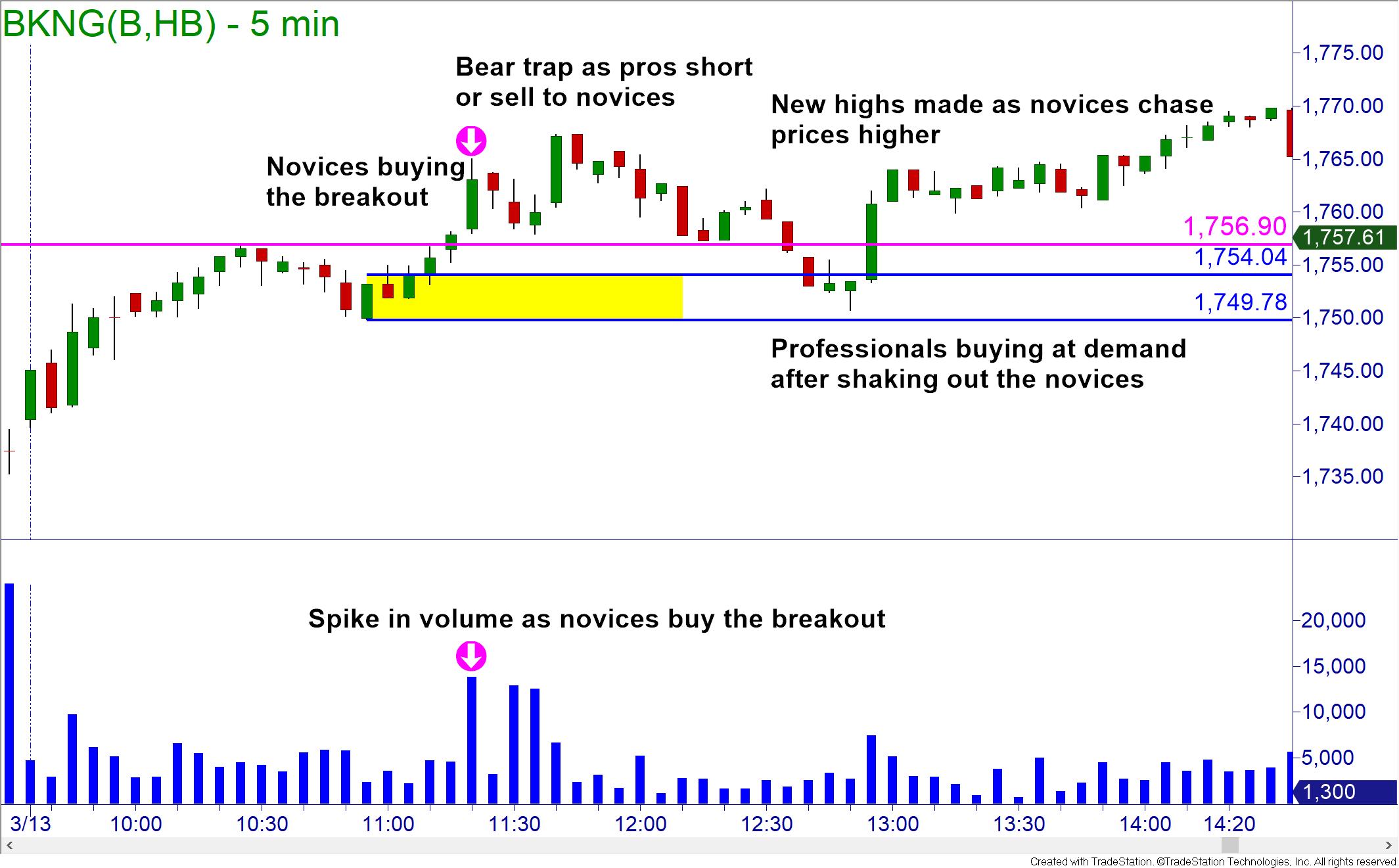

bear trap stock example

Markets move higher because of an imbalance between buying and selling pressure. These 3 bear traps chart formations provide really good buy signals especially if they form.

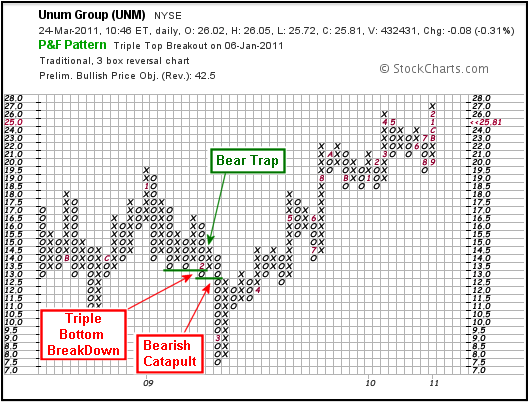

P F Bull Bear Traps Chartschool

Review Our Cookie Policy Here.

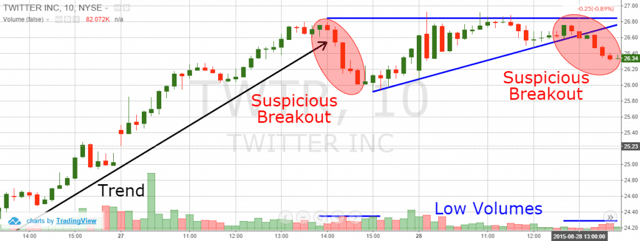

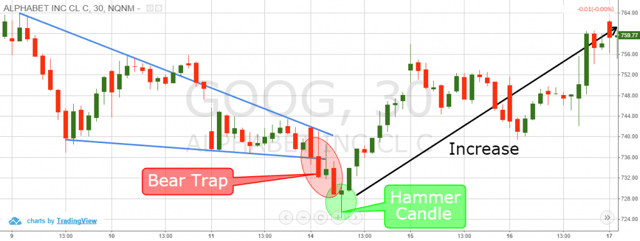

. Notice from this chart that the stock broke to fresh two-day lows and appeared on the surface to trend downwards before taking a sharp turn upwards. In general a bear trap is a technical trading pattern. Imagine were in the middle of a bull market and youre one of the inexperienced traders looking to cash in on your investment.

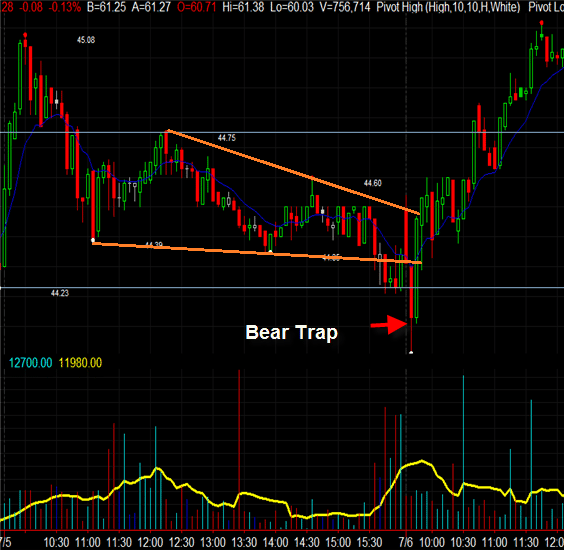

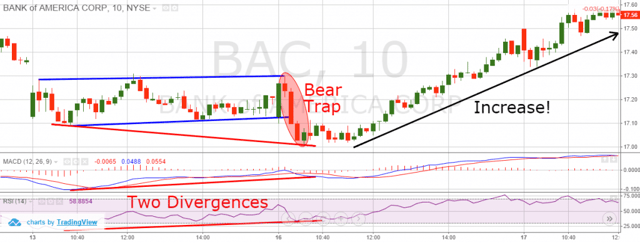

Below is an example of a bear trap on 76 for the stock. This occurs when the false reversal happens quickly and dramatically sending a stocks price much. A bear trap is a market circumstance where merchants anticipate that downward movement should proceed after an unexpected help breakout however the market shifts direction.

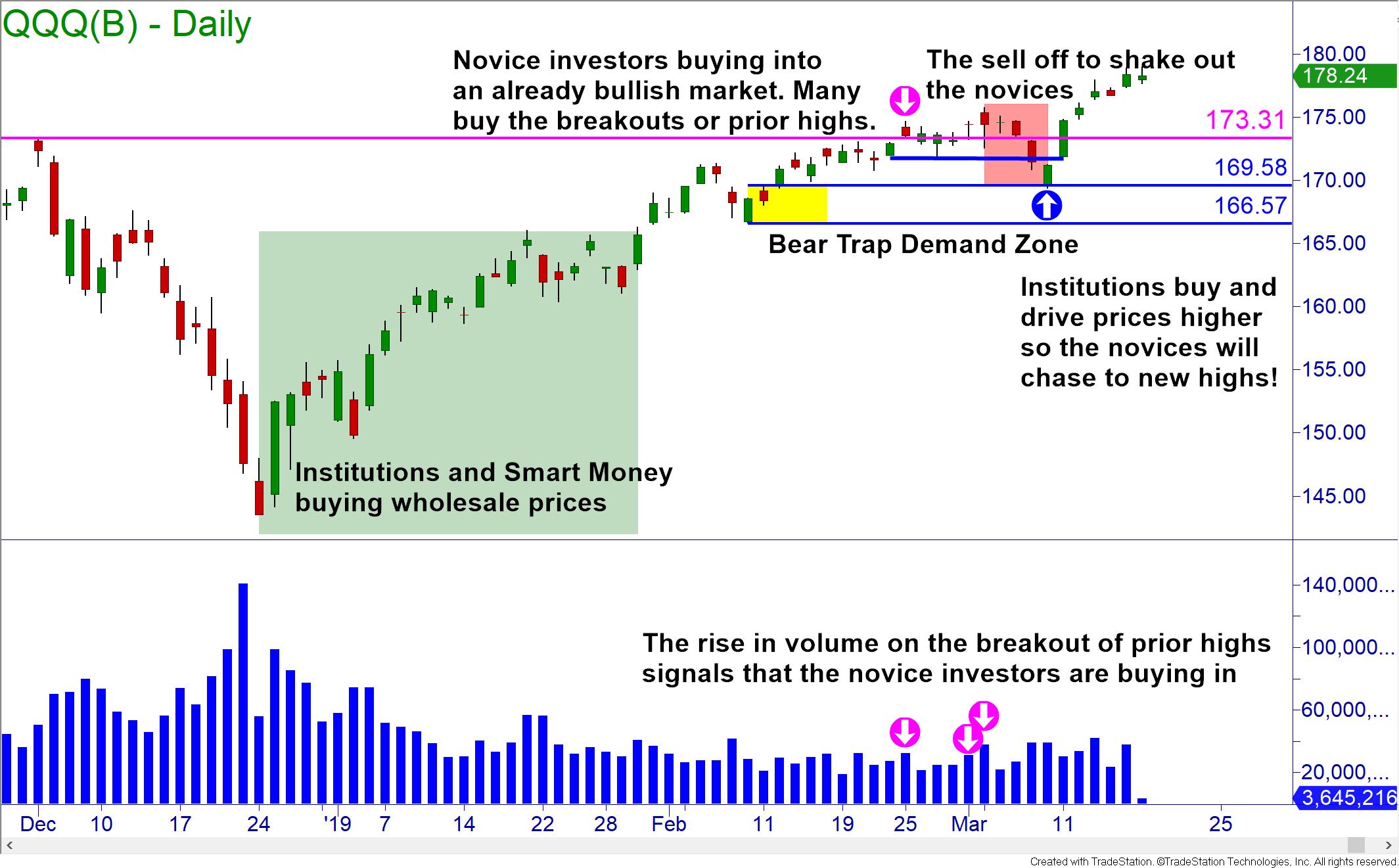

The next 1 or 2 candlesticks are bullish. The price action moves opposite to the direction shown by the technical indicator. A Bear Trap is a deliberate move by the big institutional players to trap traders into thinking there is a Short trade.

Identify Bull Traps and Bear Traps with Relative Strength Index RSI One way to identify a potential bull or bear trap is by calculating the relative strength index RSI of the asset. Bear traps occur when investors bet on a stocks price to fall but it rises instead. A Bearish Bear Trap Candlestick Breaks the support level and goes down but closes above the support level.

Bear Trap into a Short Squeeze. A bull trap is a false signal referring to a declining trend in a stock index or other security that reverses after a convincing rally and breaks a. Here is the example of that situation shown below by this bear trap chart.

Bear Trap Chart 3. Bear Trap Explained For Beginners - Warrior Trading. Bear trap example Suppose youve been keeping your eye on Company XYZs stock and after an upward trend you see the stocks price has started to slip.

A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. Bear Trap Trading Examples. Bear Trap Stock Chart Example.

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward. An example of a bear trap. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

For example when there are a lot of people wanting to buy but no sellers. To avoid the negative effects of a bear trap dont take a short position on a stock or sell your holdings just because the price has dropped. Bear Trap Chart Example.

Bear Trap Example A typical bear trap works like this. We use cookies to personalize content and ads to provide social media features and to analyze our traffic. This technical indicator allows you to check if the stock or cryptocurrency asset is overbought underbought or neither.

We also share information about your use of our site with our social media advertising and analytics partners. Example RSI Relative Strength Index divergence tool can be effectively used to identify a bear trap. Have you ever noticed price will often move just above or just below a key support or.

The RSI is an oscillator that measures. Fresh two-day lows before having a sharp counter move higher. The chart below is for the agricultural products and services retailer Agrium Inc.

For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the SPDR SP 500 ETF a US stock market proxy. Rising stock prices cause losses for bearish investors who are now trapped. The chart below is for the agricultural products and services retailer Agrium Inc.

For example intraday in forex markets or over several trading periods in the stock market. This is the prime example of a bear trap. In significant bear trap trading scenarios a bear trap can open the door to a short squeeze.

Although the definition is simple its always better to look at real-market examples. After the support is put in place just below 084 EURGBP moves higher but finds resistance at the 50 SMA yellow. 15 hours agoBalenciaga Walks Into a Bear Trap With its show at the New York Stock Exchange the French company is trying and failing to be the.

One such trap is the Bear Trap in Stocks. Illustrated below is another bear trap example with a stock. Bearish Candlestick Closing Above Support.

How to Identify a Bear Trap - Technical Analysis. These sentiment swings can happen over various time periods. For instance in this daily chart of the EURUSD pair the price broke below the support but the downtrend didnt continue.

The cryptostock prices that youre following only keep on rising so you havent sold any of your assets yet in the hope of getting a bigger profit. The cost strongly decreases and breaks the help level which draws merchants who accept the downtrend will proceed. You will notice that the stock broke to.

Bounce which will often precede the short-term top in the. Bear Trap Chart Example. You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher.

Thats because in illiquid stocks theres usually only one or two big players. This is the prime example of a bear trap in financial markets. Typically betting against a stock requires short-selling margin trading or derivatives.

Below is an example of a bear trap on 76 for the stock Agrium Inc. All things considered the financial backer may trail. For example in the past poker legends like Doyle Brunson would just play only the top hands and play it very tight to win.

If the stock price falls with low volume then a potential bullish. Bear traps spring as brokers initiate margin calls against investors. On the contrary if the trading volume is not significant it might be a bear trap.

3 Types of Candlesticks in Bear Traps 1. Bear Trap Chart Example.

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Stock Trading Definition Example How It Works

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market

What Is A Bear Trap On The Stock Market Fx Leaders

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

What Is A Bull Trap In Trading And How To Avoid It Ig En

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

3 Bear Trap Chart Patterns You Don T Know

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim